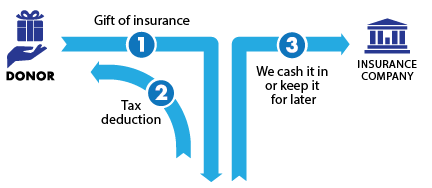

How It Works

- You transfer ownership of a paid-up life insurance policy to Voices Of Variety.

- Voices Of Variety elects to cash in the policy now or hold it.

- Consider designating and donating. It’s simple.

Benefits

- Make a gift using an asset that you and your family no longer need.

- Receive an income tax deduction equal to the cash surrender value of the policy.

- You may be able to use the cash value of your policy to fund a gift that delivers income, such as a deferred gift annuity.

Next

- More details on gifts of life insurance.

- Contact us so we can assist you through every step.

The material presented on this Planned Giving website is not offered as legal or tax advice.

Read full disclaimer|Sitemap